5 Simple Techniques For What Happens If I Leave a Creditor Off My Bankruptcy

Chapter thirteen bankruptcy. If you have enough cash flow to pay for at the very least something to creditors, you could reap the benefits of the advantages provided by Chapter thirteen, generally the repayment program.

Determined by your exclusive situation, gurus Appraise relevant laws and guidelines to provide your best choices for getting speedy reduction and have you the very best tax resolution.

According to federal bankruptcy exemption legislation, you might be able to exempt part of the auto’s equity as much as $4,450. In case your fairness exceeds the limit, quite a few factors may well occur. The trustee can provide your motor vehicle, provde the exempted volume and use the rest to pay for creditors

Earnings tax debts, by way of example, are dischargeable, but they have to fall in particular suggestions. If a tax credit card debt may very well be construed as outside the house the dischargeable range, the company might ask the choose to rule on its inclusion.

Our method is simple to comprehend. Rather than paying out your creditors, you’ll deposit a month to month payment to your Committed Personal savings Account, within your name and under your Command. As cash Construct up, we’ll Get in touch with your creditors to barter and agree on lessened balances. Simply because you’re not shelling out the creditor, they may probably view acquiring a lowered amount as much better than risking no payment in the least.

However, exceptions exist. For instance, you can't cram down a car or truck credit card debt read this if you bought the vehicle through the thirty months prior to bankruptcy. Also, filers are unable to utilize the cramdown provision to lower a household dwelling mortgage loan. Learn more about lowering loans employing a "cramdown" in Chapter thirteen.

Should you file for Chapter 7, these debts will continue being when your circumstance is about. In Chapter thirteen, you may pay back these debts in comprehensive as a result of your repayment approach.

Credit.org is actually a non-financial gain service using a 45-12 months moreover history of excellence and integrity. Best of all, their economic coaching for bankruptcy alternate options is out there at absolutely no charge. It's vital that you understand how Credit score.

You will probably have to surrender your whole credit cards when you file for Chapter 7 bankruptcy, but you can start rebuilding your credit score the moment your case is closed.

The most typical rationale you would possibly amend the bankruptcy petition is to change your identify to match the identification go to this website presented within the 341 Assembly of creditors.

When planning to file for bankruptcy, it really is typical for a possible filer to desire to "exclude" a selected credit card debt in the bankruptcy petition, for instance a credit card useful for operate expenses or maybe a beloved pet's health care costs.

Your bankruptcy lawyer will assist in crafting this approach. On top of that, an automated stay is granted, halting contact from creditors and protecting against repossession or foreclosure. Chapter 11 Chapter 11 bankruptcy is often by far the most sophisticated and costly style of bankruptcy proceeding. It requires thorough thought and thorough Investigation of all see choices before continuing. This option is mostly used by enterprises in search of to reorganize their debts whilst continuing operations. An excessive amount Debt? Allow us to Assist you to Do away with Your Debt

It's official source normal to amend this manner to repair omissions. You may have neglected to checklist a savings account by using a minimal balance you almost never use or even a retirement account you cashed out several discover here months in advance of submitting.

But, an increase in the amount of issues from SoFi purchasers that explain negative encounters - especially in the customer care Office - gave us some cause for concern.

Scott Baio Then & Now!

Scott Baio Then & Now! Michael Oliver Then & Now!

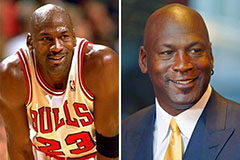

Michael Oliver Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!